What to Expect: Performing Environmental Due Diligence

You are interested in purchasing, refinancing or leasing a commercial property. As one who prefers to make well-informed, risk-identified transactions, you know the importance of a Phase I Environmental Site Assessment (Phase I) and plan to perform due diligence. While you know of a Phase I and are on the cusp of choosing a consultant, […]

Cooperstown Environmental Supports Merrimack River Conservation Efforts

Susan Curtis, Managing Principal of Cooperstown Environmental, attended the Merrimack River Watershed Council’s (MRWC) 4th annual State of the Waters 2020 Conference on January 31st. The conference helps to publicize an increased awareness of the economic, recreational and cultural importance of the Merrimack River to our region. This year’s theme was Next Generation Pollution: The Challenges and Solutions. Among the lecture […]

TAX IMPLICATIONS OF USING MASSACHUSETTS BROWNFIELDS TAX CREDITS

The Massachusetts Brownfields Tax Credit program, created in 1998 to help spur the cleanup and redevelopment of contaminated commercial and industrial properties throughout the state, has been an exceptionally successful program. Hundreds of property owners who are “Eligible Persons” – which the law defines as parties who did not cause or contribute to the contamination […]

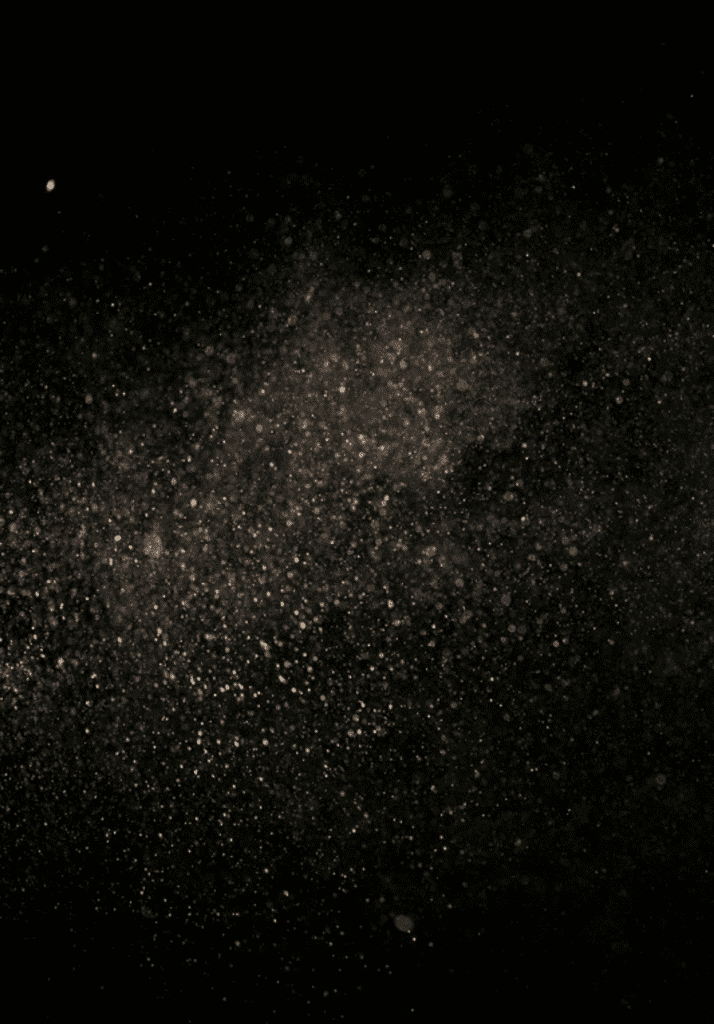

Monitoring Risk from Dust at MCP Sites

Dust inhalation as a health issue has received increasing scrutiny at construction and remediation sites nationwide and in Massachusetts. Historically, the focus has been on the inhalation of respirable particulates by workers; fortunately, instrumentation is readily available that provides real-time worksite data for particulate concentrations in air. However, the focus is now broadening to include […]

Is Your Brownfields Property in an Economically Distressed Area?

An EDA designation is an eligibility requirement to receive Massachusetts Brownfields Tax Credits – but what if your project is not in a qualified area? To qualify for a Massachusetts Brownfields Tax Credit, a property must be located in an “Economically Distressed Area” (EDA). Contrary to what that phrase implies, many of the state’s more […]

Lawrence Company Redeems $30k from Brownfield Tax Credit Program

Prospect Iron and Steel Corporation is a family company that was started by the grandfather and granduncle of current vice president Bob Nash more than 92 years ago. After 87 years in Somerville, Prospect Iron and Steel moved their scrap recycling business to Lawrence, Massachusetts in 2014, a move prompted by an eminent domain taking to […]